Understanding Stability Strategy

The contemporary business world is highly competitive, and companies often prioritize rapid growth and intense expansion. Nevertheless, some organizations also focus on maintaining their current market position to ensure operational efficiency and minimize risks more effectively.

This process is referred to as a stability strategy, a company model whereby consistency is valued rather than growth. Companies that have already reached a stage of maturity, work in a saturated market, or desire to consolidate their already gained popularity and illustrate their success afterward, may choose a stability strategy.

But does this mean the company stops growing entirely? This article examines why companies adopt stability strategies, explore various types of stability strategies, provide real-world examples, and offers insights on selecting the most suitable approach.

A stability strategy is used when an organization chooses to maintain its current position rather than pursuing rapid growth or diversification. It focuses on consistent performance, efficiency, and sustaining market share. At Altera Institute, students learn how such strategies help businesses navigate uncertainty with confidence — preparing them to make sound, steady decisions in real-world management roles.

Why does any Company Adopts Stability Strategy?

Companies adopt a stability strategy for several reasons, especially when external or internal forces discourage aggressive growth. The following are the main reasons why a firm can follow this route:

1) Due to Market Maturity

In mature industries where growth opportunities are limited, companies may choose to consolidate their existing market position rather than seek expansion. When a market reaches saturation, competing for additional market share can be costly and unprofitable.

Example: Established utility companies (electricity, water, and gas providers) often adopt stability strategies due to regulated pricing and consistent demand.

2) Due to Economic Uncertainty

Stability is often chosen during economic crises, economic downturns, or times of market volatility, when businesses are likely to be reflecting on their tools to conserve resources and thus survive over time. Growth in a turbulent environment can subject the firm to more unwarranted financial pressure.

Example: Due to the COVID-19 pandemic, many retail brands scaled back their expansion strategies and focused on operational sustainability to navigate supply chain disruptions and adapt to changing consumer behavior.

3) To Attain Cost Efficiency

Companies that want to improve financial efficiency without increasing operational complexity often adopt stability strategies. Instead of expanding, they focus on cost-cutting, operational improvements, and optimizing resources to maintain profitability.

Example: Fast-food chains like McDonald's often focus on menu optimization and cost-effective supply chain management instead of frequently opening new locations.

4) To Retain Competitive Advantage

In highly competitive markets, where focusing on competitiveness does not result in a company winning expansion battles, stability helps a business to build its brand name, customer loyalty, and operational efficiency, instead of taking it on.

Example: Luxury brands such as Rolex and Ferrari will retain their status by maintaining small product lines and focusing on quality rather than a mass-market approach.

5) Due to Internal Constraints

There are companies that might not have capital, leadership vision, or capacity to expand. They choose to maintain stability so that they will have a steady stream of revenue and continuity of business rather than incur financial responsibilities or managerial issues.

Example: Family-owned businesses often prioritize long-term stability over rapid expansion to preserve their legacy and maintain financial security.

6) Due to Regulatory Restrictions

Certain industries are highly regulated by the government, and they cannot be expanded or are subject to a lot of compliance. In these situations, organizations tend to focus on operations-based optimization rather than making high-growth ventures.

Example: In certain cases, pharmaceutical firms must undergo extensive FDA approval for new drugs; therefore, stability strategies are more viable.

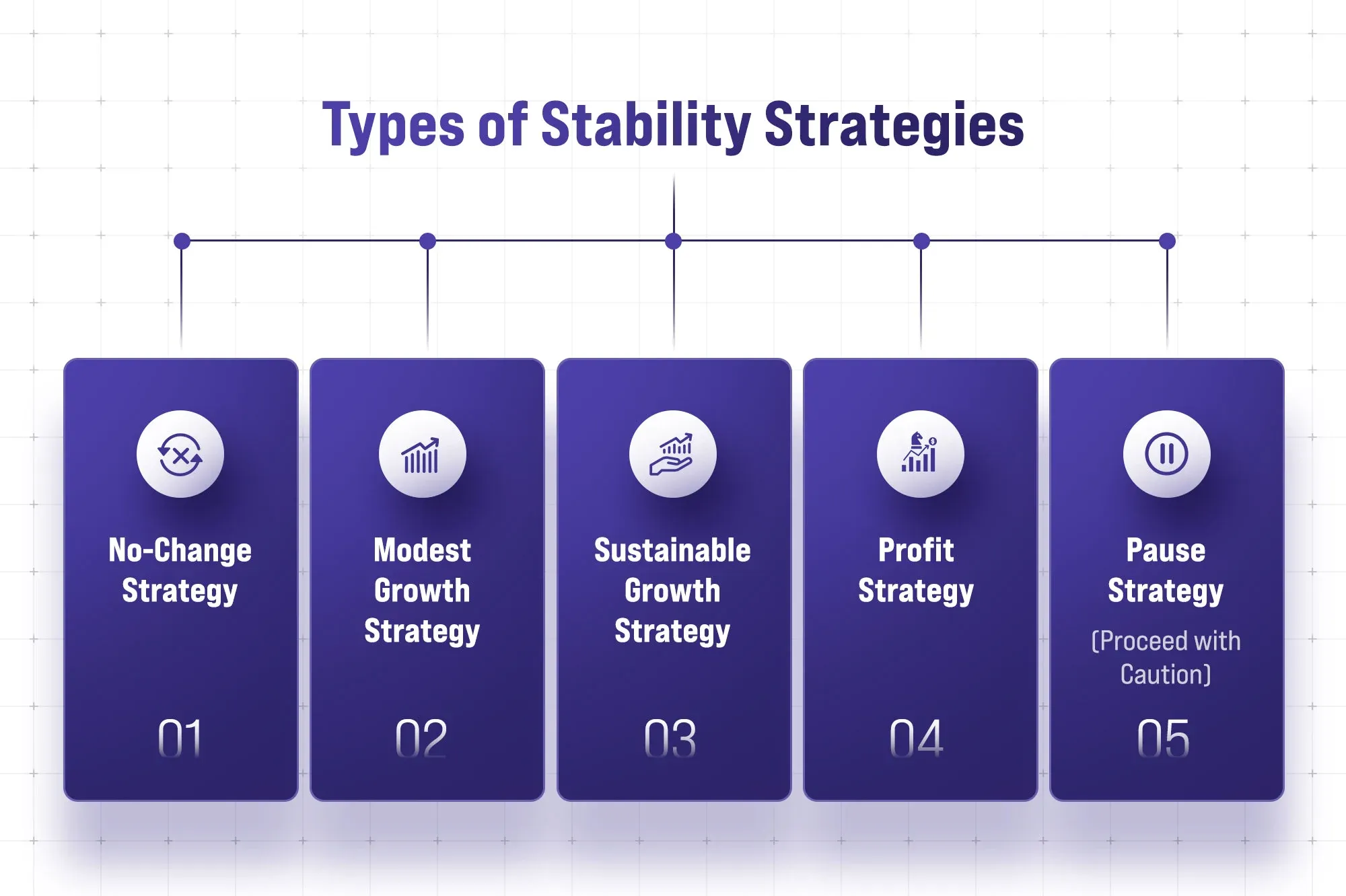

Types of Stability Strategies

There are several types of stability strategies that companies implement, depending on their circumstances, objectives, and industry conditions. The five primary categories of stability strategies, along with their unique characteristics, advantages, and disadvantages, are listed below.

1) No-Change Strategy

A no-change strategy refers to a situation where a business maintains its current business practices without any major changes in terms of products, services, or its market positioning. The company still operates in the same manner as it did in previous years, as it is concerned with stability rather than innovation or expansion.

Features:

- In this strategy, no significant changes are implemented in operations, processes, or market presence.

- This strategy is implemented by companies that are content with their current level of performance and have minimal risk.

- It is geared towards consistency, customer satisfaction, and operational stability, rather than growth or expansion.

Advantages:

- It reduces risk, since there is no need to make unnecessary changes that may disrupt operations.

- The company enjoys a stable stream of income and dependable, predictable business performance.

- Professionals are also well employed since the organization does not experience unexpected or unstable organizational changes.

Disadvantages:

- The inability to innovate and evolve may eventually result in stagnation, which will hinder progress.

- New products or services may be launched by competitors, and the company will lose market relevance.

- This strategy is not applicable to industries that require constant adjustments to technological changes and market dynamics.

2) Modest Growth Strategy

A modest growth strategy entails ambitious growth targets that are gradual and sustainable instead of being aggressive. It is focused on continuous improvement as opposed to grand-scale acquisition attempts.

Features:

- The modest growth strategy aims for small, incremental growth while maintaining operational stability.

- Companies following this approach set realistic goals, often targeting the same growth rate achieved in the previous year.

- Expansion is achieved by making minor improvements in efficiency, marketing, or customer service, as opposed to massive expansion.

Advantages:

- The approach will ensure a gradual change without excessive risks of aggressive scaling.

- It enables companies to consolidate their market shares while remaining financially stable.

- Loyalty to customers and brand name is not lost because no drastic changes are made to upset the existing business model.

Disadvantages:

- The slow growth rate may not be enough to compete with aggressive market players.

- Limited innovation and expansion may restrict long-term business potential.

- This method may not be applicable in highly competitive or rapidly changing industries where rapid adaptation is required.

3) Sustainable Growth Strategy

A sustainable growth strategy is used when businesses restrain their growth because of external factors, e.g., economic recessions, scarcity of resources, or market uncertainty. It is all about long-term sustainability rather than temporary growth.

Features:

- The sustainable growth strategy focuses on expanding at a manageable and realistic pace that does not put excessive pressure on financial or operational resources.

- Companies adopting this strategy ensure that growth aligns with existing market conditions and internal capabilities.

- This approach is often employed when market conditions are unpredictable, enabling businesses to survive and thrive without overextending themselves.

Advantages:

- By only expanding where it can manage, the company is eliminating financial pressure and waste in operations.

- Businesses are flexible, making it easier to adjust their business strategies in response to market changes.

- It is profitable whilst being sustainable in the long term.

Disadvantages:

- This can result in slower decision-making because businesses must continually evaluate market conditions to make a decision.

- There is a risk of missing growth opportunities if the company is overly cautious.

- This approach may not produce quick gains in market share and, therefore, is not suitable for businesses that need quick growth in order to compete favorably

4) Profit Strategy

A profit strategy is adopted when the company intends to make as much profit as possible without having to grow its business. The aim is to cut costs, micro-manage prices, and increase productivity, rather than pursuing top-line development.

Features:

- The profit strategy is designed to achieve high profitability without expanding the business.

- This is a strategy employed by companies to optimize internal processes, minimize expenses, maximize revenue, or streamline operations, with the goal of enhancing their financial performance.

- It is commonly taken as a short-term solution to economic crises or unstable markets.

Advantages:

- The business is able to sustain itself financially even in a challenging market environment.

- The reduction of costs and increase in efficiency boost profitability without the need for additional investments.

- The company is able to consolidate its operations and then wait until market conditions improve before it thinks about expansion.

Disadvantages:

- Excessive cost-cutting may lead to lower product quality, reduced employee morale, or weaker customer satisfaction.

- Raising prices to improve margins might backfire as it can alienate customers and shrink demand.

- Since it is a short-term solution, this strategy may not be sustainable for long-term business growth.

5) Pause Strategy (Proceed with Caution)

A pause strategy refers to the situation where an organization takes a short-term pause in growth and re-examines its strategic orientation. This strategy can enable companies to unify the historical growth, re-evaluate internal strengths, and anticipate future market changes.

Features:

- Pause strategy helps companies to temporarily suspend aggressive growth initiatives, stabilize, re-evaluate, or reorganize after a brief growth spurt.

- This strategy is commonly employed when a company has experienced significant growth and requires time to consolidate its position before continuing its expansion.

- Companies tend to focus on internal development rather than expanding into the outside world, i.e., enhancing operational efficiency or financial security.

Advantages:

- It enables businesses to regain control and optimize internal operations before embarking on further growth.

- The plan enables the leadership to focus on long-term plans and set achievable growth targets.

- It minimizes operational and financial risks by ensuring that expansion is done in a systematic manner.

Disadvantages:

- The company may lose momentum in the market if it pauses its growth initiatives.

- Competitors may take advantage of this pause period to gain a competitive edge.

- Ineffective communication of this strategy may lead to misunderstandings between staff and investors.

Examples of Stability Strategy in Business

1) Coca-Cola -Status Quo in the name of Brand Identity

In the economic crises of the late 20th and early 21st centuries, such as the 2008 financial crisis, Coca-Cola used a no-change strategy, which strengthened its main brand rather than diversifying into risky enterprises. Coca-Cola remained stable in the long term by maintaining its flagship product, concentrating on international marketing, and improving product distribution.

2) McDonalds - Operational Efficiency Profit Strategy

In the 2008 recession, McDonalds implemented a profit strategy of focusing on operational efficiency rather than aggressively expanding. The company also reduced its supply chain, automated ordering systems, and focused on low-cost menu items, including the Dollar Menu, rather than opening new stores. This strategy enabled McDonald's to remain profitable even during a period of financial turmoil, without significantly altering its basic business model.

3) Apple – Pause Strategy for Product Refinement

After the dot-com bubble had burst in the early 2000s, Apple took a strategic hiatus on major innovations to re-examine its position in the market. Apple did not rush to introduce a new product to the market, but instead decided to refine its Mac products before releasing the iPod in 2001. This conservative strategy contributed to Apple gaining momentum, and it was this that enabled innovations like the iPhone to be supported by thorough market research and consumer knowledge.

4) Unilever – Sustainable Growth Strategy for Long-Term Success

In the 2010s, with growing concerns about environmental sustainability, Unilever adopted a sustainable growth strategy to meet shifting consumer preferences. The corporation put emphasis on biodegradable materials, ethical supply chains, and reduced environmental impact throughout its operations rather than focusing on how to penetrate the market rapidly. This strategy has enabled Unilever to achieve stable financial performance while also building a strong brand identity.

How to Choose the Right Stability Strategy?

The selection of the best stability strategy is based on major variables, including market trends, fiscal stability, competition, and overall objectives.

Before choosing a strategy that can guarantee sustainable performance and reduce the risk, a company should assess its internal resources and the external environment. The following is how businesses may select the most appropriate stability strategy:

1) Assess Market Conditions

The knowledge of the market environment is essential in choosing a strategy of stability. Companies should analyze:

- Market Growth Rate: When the industry is experiencing steady growth, a small growth strategy can be appropriate. On the other hand, a profit strategy might be more effective in mature or saturated markets.

- Competition Level: In a highly competitive business environment, a no-change strategy (status quo) might not be a workable option. A sustainable growth strategy makes the business stay competitive but not go overboard.

- Economic Stability: In uncertain economic conditions, a pause strategy enables businesses to consolidate their resources before making strategic moves.

2) Evaluate Financial Health

Financial stability determines whether a business can afford to grow or should focus on sustaining its profitability.

- Strong Cash Flow & Resources: When a company possesses sufficient funds at its disposal and does not wish to take excessive risks, then a smaller growth strategy is a prudent plan.

- Limited Financial Resources: Businesses with limited financial resources should consider a profit strategy to enhance efficiency and maximize their margins.

- Financial Uncertainty: In the event of economic uncertainty or high debt levels, the pause strategy can help avoid unnecessary risks and enhance financial strength.

3) Competitive Positioning Analysis

The competitive position of the company is a crucial factor to be considered when choosing the most appropriate stability strategy:

- Powerful Market Position: When a company already dominates its market, it might be suitable to adopt a no-change policy. Nonetheless, there is a need to innovate occasionally in order to avoid stagnation.

- Moderate Competition: A Sustainable Growth Strategy provides businesses with the opportunity to maintain their current position and be prepared to seize tomorrow's opportunities.

- Intense Competition: Firms with tough competition ought to adopt a Profit Strategy in order to enhance cost-saving and profitability.

4) Define Long-Term Business Goals

Each company has its own goals, and the selected strategy must correspond to the vision in the long term:

- Maintaining the Market Position: A no-change Strategy is best suited to businesses concerned with consistency and risk aversion.

- Incremental Expansion: A modest growth strategy enables controlled growth while maintaining stability.

- Efficiency and Profitability: A profit strategy is ideal for companies seeking to enhance margins without expanding operations.

- Re-Evaluation and Planning: A pause strategy is effective when a company needs time to reflect and make informed strategic decisions.

FAQs

Q1. What are the 4 levels of strategy?

Ans: The four levels of strategy in an organization are:

- Corporate Strategy: The highest level, focusing on overall business direction, diversification, mergers, and acquisitions.

- Business Strategy: This determines how a firm competes in a given market or industry.

- Functional Strategy: It concerns itself with strategies at departmental levels (e.g., marketing campaign, finance, operations) to facilitate business goals.

- Operational Strategy: Focuses on specific processes and daily operations to enhance efficiency and achieve functional objectives.

Q2. What are the 4 Ps of Service strategy?

Ans: The 4 Ps of Strategy, as developed by Henry Mintzberg, outline various strategies for strategic planning:

- Plan: A systematic strategy of the organizational actions.

- Pattern: A consistent approach or behavior that emerges over time.

- Position: This is the distinct manner in which a brand differentiates itself in the market.

- Perspective: The company's philosophy, culture, and attitude towards the business strategy.

Summing Up

A stability strategy enables a business to stabilize its position in the market, streamline its operations, and reduce risks instead of embarking on ambitious expansion. The reasons companies choose this approach include market maturity, economic unpredictability, limited funds, or government-imposed restrictions.

Ultimately, stability strategies allow companies to consolidate strengths, optimize resources, and maintain a steady market presence without exposing themselves to unnecessary risks. While stability does not mean stagnation, it provides a foundation for future strategic moves, ensuring businesses remain resilient, competitive, and financially sound in the long run.