Business Research Methods: Types and Examples

The current business environment is both sophisticated and data-driven and cannot be based on intuition and experience. Rather, it requires evidence-supported decision-making, in which judgments guide behavior rather than suppositions. To arrive at these critical insights, appropriate business research is essential.

Business research can enable organizations to make informed, strategic decisions and adapt to market conditions and future aspirations, as it helps determine customer preferences and streamline internal processes.

Understanding business research methods is essential for making informed decisions, whether you're analyzing markets, customers, or performance. The PGP in Marketing at Altera Institute integrates these research approaches through hands-on projects and practical frameworks. If you want to see how these concepts are applied in real marketing roles, you can check out our PGP program in Marketing for a clearer perspective.

The article will define business research, subdivide its fundamental approaches, types, and applications, and discuss its crucial role in strategy development, using practical examples.

What is Business Research?

Business research is a systematic process of gathering, analyzing, and drawing meaning from data so as to make informed and strategic business decisions. It helps businesses interpret market changes, consumer tastes, operational efficiency, financial health, and competitive position. Business research uses systematic methods to convert unstructured data into usable intelligence, helping minimize ambiguity, and enhance decision-making.

At its core, business research bridges the gap between intuition and evidence. Whether an enterprise is introducing an innovation, expanding into untapped markets, or refining workflows, research provides the empirical basis for assessing alternatives, forecasting results, and mitigating potential risks.

What are the Types and Research Methodologies in Business?

The methodology of business research spans diverse techniques, but fundamentally, it falls into two core categories: qualitative and quantitative analysis. Each method serves distinct purposes and provides different kinds of insights depending on the nature of the problem being addressed. Let’s dive deeper into each of these methods.

1. Qualitative Research Methods

Qualitative research delves into human actions, underlying motivations, perspectives, and societal influences, aiming to uncover the reasons and mechanisms behind observed phenomena. This type of research is particularly useful in the early stages of problem-solving, when businesses seek deep, open-ended insights into a topic.

Key Features:

- Descriptive and exploratory nature.

- Uses small samples that are not random.

- In most cases, unstructured or semi-structured data collection methods are employed.

- Findings are not quantitative; they are thematic or descriptive.

Common Qualitative Techniques:

- Interviews: One-on-one discussions that reveal personal opinions and in-depth insights.

- Focus Groups: Guided group discussions used to explore consumer perceptions or reactions.

- Case Studies: In-depth analyses of specific real-world scenarios or company cases that reveal valuable, scalable insights.

- Observations: Watching how people interact with a product, service, or system in a natural setting.

When to Use It:

- Launching a new product or service and needing to understand potential customer attitudes.

- Delving into brand perception or employee satisfaction.

- Determining the unmet needs or patterns of behavior that cannot be seen right away based on numbers.

2. Quantitative Research Methods

Quantitative research, in contrast, revolves around measurable data, employing structured techniques to gather and interpret information, validating theories, and detecting trends. The results are statistically significant, and this form of research is essential when businesses need to generalize findings across a broader population.

Key Features:

- Structured and objective approach.

- Relies on large, representative samples.

- Data is collected in numerical form and analyzed statistically.

- Results can be measured, compared, and replicated.

Common Quantitative Techniques:

- Surveys and Questionnaires: Used to collect large amounts of data quickly from target audiences.

- Experiments: Controlled studies that measure the effect of changes in variables.

- Market Analytics: Involves mining large datasets, such as sales data or website traffic, for trends.

- Statistical Analysis: Regression, correlation, and forecasting tools are used to make data-driven predictions.

When to Use It:

- Estimating market size or segment demand.

- Testing the effectiveness of a marketing campaign.

- Measuring customer satisfaction across a broad demographic.

- Validating assumptions made from qualitative research.

3. Combining Both Methods

Understanding the types of research methods in business research, many businesses find the greatest value in combining qualitative and quantitative methods, a practice known as mixed-methods research. For example, qualitative research can highlight an unexpected customer issue, which can then be quantified through a quantitative survey. Collectively, they form a more practical, all-encompassing image.

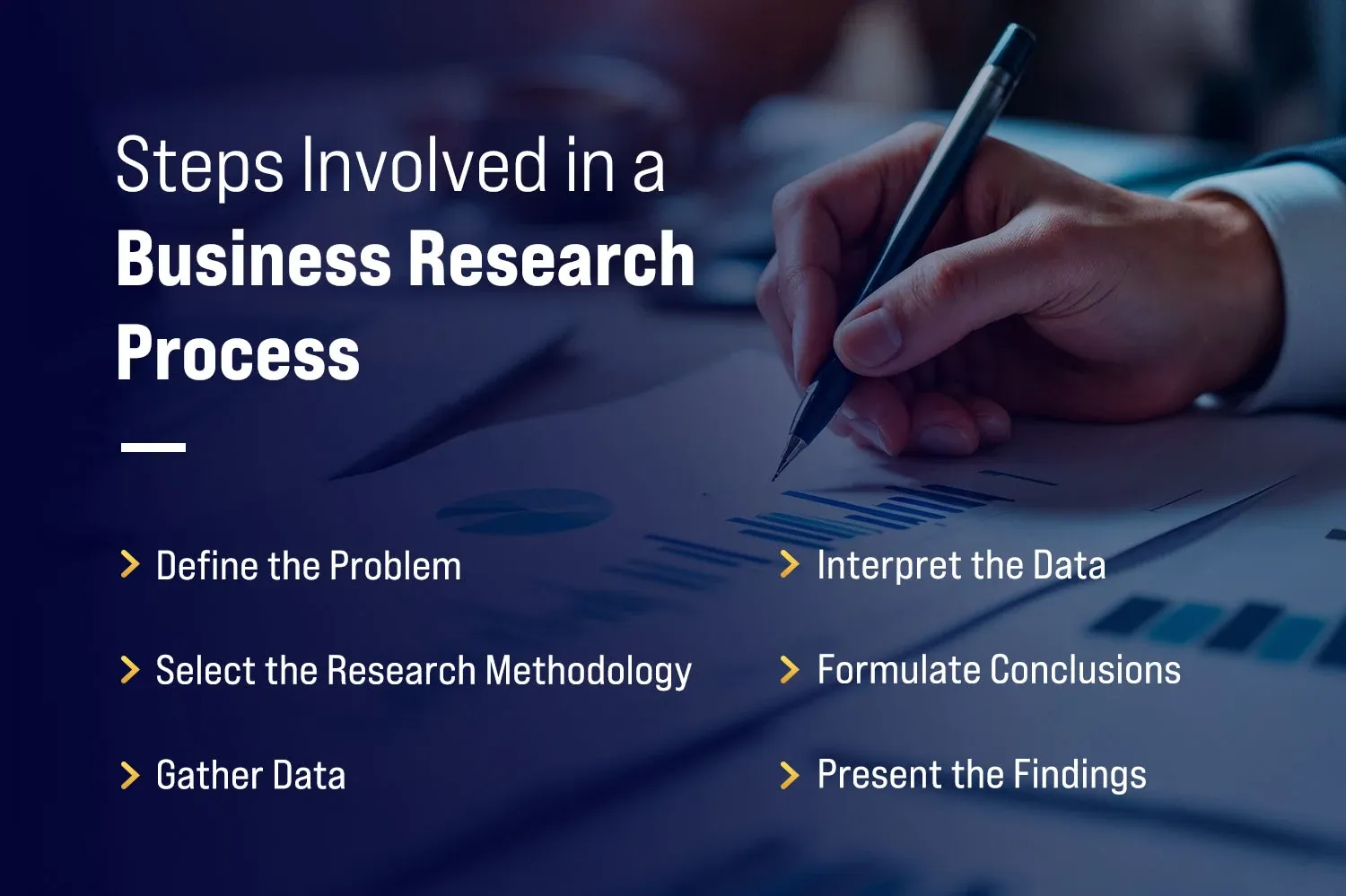

Processes Involved in Business Research

The business research process is a systematic journey that converts a business question into credible, actionable information. Following such a structured design makes it accurate and relevant. Below is a breakdown of the various important stages:

1. Define the Problem

A clear and concise definition of the problem is the first step towards every successful research process. This is arguably the most crucial step since it determines the course of the whole investigation; an ill-constructed problem may result in irrelevant conclusions, misplaced resource allocation, and wrong judgments.

For instance, rather than asking a vague question like “Why aren’t we growing?”, a well-defined problem would be “What factors are contributing to a 15% drop in customer retention in the past two quarters?” The more precise the research question, the more streamlined the study design becomes.

2. Select the Research Methodology

After defining the problem, the next step is to select a suitable research approach and determine whether qualitative, quantitative, or a hybrid method best addresses the inquiry.

For exploratory questions or those that require a deeper understanding of human behavior, qualitative methods such as interviews and focus groups are ideal. For more measurable outcomes, such as identifying trends or forecasting demand, quantitative approaches, such as surveys or statistical analysis, are preferred.

Choosing the right methodology ensures that the data collected will be relevant and robust enough to guide strategic decisions.

3. Gather Data

Data collection is the foundation of any research process, and the integrity of your insights depends on it. At this stage, researchers collect primary or secondary data depending on the research plan.

Primary data is the first-hand data, which is obtained by means of customer surveys, interviews, and field experimentation. Secondary data, on the other hand, are acquired from existing materials such as industry reports, company records, or official documents.

The data-gathering method should align with the research project's goals, timeframe, and available resources. Accuracy, consistency, and ethical data handling are crucial here.

4. Interpret the Data

Raw data alone cannot drive decisions, and it first needs context and meaning. This stage entails systematizing, analyzing, and deriving meaning from data to reveal connections, tendencies, and actionable insights.

With quantitative data, statistical tests such as regression analysis, data visualization, and hypothesis testing can be applied. In qualitative data analysis, it is common practice to code themes and identify narratives.

Effective data interpretation bridges the gap between collection and insight, turning facts into actionable understanding.

5. Formulate Conclusions

This is where insights take shape, and the research begins to pay off. Based on the interpreted data, researchers draw logical conclusions that directly address the original problem.

To illustrate, when the study indicates that customer churn may be related to a lack of post-purchase support, the conclusion could be that specific alterations to customer service procedures are needed.

These conclusions must be realistic, objective, and closely based on the data, with no assumptions or generalizations.

6. Present the Findings

Lastly, the research should be shared with stakeholders who will take action on the same. The presentation stage does not only involve presenting the results but also telling a story supported by evidence.

To have a good report or presentation, it will usually contain:

- A restatement of the problem

- The methodology used

- Key findings

- Conclusions and actionable recommendations

Visual tools such as graphs, infographics, and executive summaries are often used to enhance clarity and impact, enabling decision-makers to grasp insights and take informed action quickly.

Why is Business Research Important?

Business research serves as the compass that guides organizations in the right direction, grounded in real-world data and aimed at continuous improvement. It is not limited to large companies; research-based decision-making can be of great use to even small startups. Here is why business research is so important:

1. To Understand Customers Better

The basis of any business success is its understanding of the customers. Businesses can obtain vital information about demographics and behaviors through targeted research methods, including online surveys, interviews, and feedback forms. Having knowledge of who they are, what they desire, and how they view your brand helps you serve them in a better way.

For example, when survey data indicates that most of your buyers are working adults aged 25-35 and are more concerned with convenience, you can adjust your services and communications to reflect that lifestyle. This aids in the creation of individualized experiences, enhances customer satisfaction, and finally creates long-term loyalty.

2. To Identify Problem Areas

Since no business is ideal, research will help identify where exactly things are going wrong. Through tools such as employee feedback check-ups or customer satisfaction questionnaires, companies are able to identify inefficiencies or gaps in service or flaws in products.

These insights allow strategic adjustments, whether it's refining customer service protocols or revamping an underperforming product. The process of conducting such research on a regular basis forms a feedback mechanism that ensures that your business remains flexible and responsive to both internal and external demands.

3. To Initiate Comparative Studies

Business research provides a lens for viewing your competitors and benchmarking your own performance. By benchmarking your products or services against industry rivals, you can pinpoint deficiencies in features, cost strategies, or promotional tactics.

Let’s say a competing brand is gaining market share. Through comparative research, you might discover that their customer onboarding process is faster or their social media engagement is higher. This information equips you to make informed improvements rather than blindly playing catch-up.

4. To Engineer New Business Opportunities

Business research is an important tool for innovation, grounded in insight and the uncovering of new opportunities. It could be the need to expand markets, develop new products, or renovate the brand, but research is an empirically based guiding force to action.

For instance, if customer surveys reveal a demand for eco-friendly packaging, introducing a green product variant could set you apart in the market. Instead of just guessing, you’re solving a problem that your audience has already voiced. Research also allows you to test new ideas on smaller audiences first, minimizing risk while exploring growth.

5. To Minimizes Loss

Amongst the most neglected yet effective advantages of business research is the fact that it allows one to avoid expensive errors. Research can be used to justify assumptions and predict the results before investing resources in a new campaign, product, or service.

Pilot testing or customer testing on an idea minimizes the possibility of failure. When a new service idea gets low interest in initial surveys, you have saved money, time, and effort, which would otherwise go to waste in a full-scale launch. Likewise, the improvement of already existing services through the actual user feedback will increase the success rates and minimize the returns or complaints.

Business Research to Improve Company Strategy

A company’s strategy is only as strong as the insights that shape it. This is where business research becomes indispensable, serving as a guiding framework that enables organizations to make informed choices grounded in evidence, trends, and real-world data.

A research-based approach is of benefit to each strategic pillar of a business, including marketing, product development, and financial planning, down to logistics. Let's see how:

1. Market Analysis

A company should be aware of the ground on which it operates before it can successfully compete. Market research helps companies evaluate and manoeuvre through the competitive environment and external conditions that define their industry. These involve the profiling of customer segments, monitoring consumer behavior, determining trends, and assessing the size and dynamics of the market.

Equipped with these findings, companies can refine their approaches to align with actual market needs rather than conjecture. It helps companies to recognize unmet segments, trends, and changes in customer preferences, which eventually inform product development, marketing approaches, and market penetration.

2. Financial Analysis

The sustainability of a strategy can only be achieved when the business is financially viable. Financial analysis business research penetrates into internal documents like balance sheets, income statements, cash flow statements, and key performance ratios. Such insights enable leaders to evaluate profitability, expense structures, and end-line fiscal stability.

Such analysis allows leaders to forecast revenue trends, optimize expenditures, and make investment decisions grounded in data. Whether it’s reducing operational costs or maximizing ROI, research helps sharpen the financial tools that fuel long-term growth.

3. Brand Analysis

The perception and attitude of people towards your brand may have a huge impact on its success. Research-based brand analysis helps evaluate a company's image in its customers' eyes, its reputation, and its brand equity. Common research instruments in this field include customer surveys, focus groups, online reviews, and social listening platforms.

These are invaluable insights in the process of perfecting messaging, positioning the brand in the right place in the market, and dealing with perception gaps. An effective brand that targets its audience well promotes increased interaction, loyalty, and customer relationships.

4. Product Analysis

The success of a business hinges on its offerings. Product analysis involves studying performance metrics, customer satisfaction, competitive positioning, and usability. Research in this domain helps determine whether a product is meeting customer expectations and where enhancements can be made.

Customer feedback, feature comparisons, and sales trends are key indicators. They allow businesses to fine-tune existing products, phase out underperforming ones, and explore opportunities for innovation. The use of data-driven product management and development processes keeps the offerings in line with the market needs.

5. Risk Analysis

Uncertainty is a real issue in every business, but through proper risk analysis with the support of research, the company can anticipate and plan how to react to it. This requires identifying potential threats, such as economic downturns, regulatory changes, cybersecurity threats, and supply chain disruptions.

By using scenario planning, historical data analysis, and predictive modeling, businesses can come up with strong contingency plans. Research can lead to anticipatory risk mitigation, which guarantees organizational flexibility in changing circumstances.

6. Competitor Analysis

There is no strategy that can be complete without knowledge about the competition. Competitor analysis is the process of monitoring competitors' activities, including analyzing their products, pricing, market strategies, and customer responses. This kind of analysis gives the business the chance to identify its competitive strengths and weaknesses.

By understanding competitors' strengths and weaknesses, businesses can exploit market gaps, compare themselves to competitors, and adapt their strategies based on the analysis. Its aim is not to copy but to be strategically superior by making informed and data-driven decisions.

7. Demand Analysis

Understanding customer preferences and demand cycles is critical for optimizing operational workflows. Demand analysis helps predict future needs by studying purchase patterns, economic indicators, seasonal behavior, and consumer sentiment.

This research is vital for managing inventory, pricing, and marketing campaigns. It helps businesses avoid the twin pitfalls of overproduction and stockouts, ensuring they can meet demand without unnecessary costs or wasted resources.

8. Distribution Analysis

The best product in the world means little if it can’t be delivered efficiently. Distribution analysis focuses on logistics, which includes evaluating channels, delivery timelines, transportation methods, and costs. Researching supply chain dynamics reveals inefficiencies, delays, and opportunities for enhancement.

With data on hand, companies can choose the most effective distribution channels, reduce delivery times, enhance customer satisfaction, and improve overall supply chain management.

Examples of Business Research

1. Netflix vs. Blockbuster: Using Consumer Data to Shape Strategy

Perhaps one of the most iconic examples of how business research can shape a company's fate lies in the story of Netflix and Blockbuster.

The Situation:

In the early 2000s, Blockbuster reigned as the leader in video rentals, while Netflix was just beginning to disrupt the market with its subscription-based DVD delivery model. What set Netflix apart was its early commitment to using business research and customer data to understand consumer behavior.

The Research:

Netflix analyzed patterns in customer rentals, preferences, and viewing habits. They also conducted predictive analytics to determine what users were most likely to watch next. Rather than relying on assumptions, they made data-driven decisions about what films to recommend, what content to license, and—eventually—what original shows to produce.

Blockbuster, by contrast, failed to adapt. They neglected emerging digital trends and did not invest in understanding shifting consumer preferences for convenience and online content.

The Result:

Netflix started as a streaming platform but became a content creator, making decisions at each step based on research. Blockbuster's late reaction and reliance on outdated business models led to its bankruptcy in 2010.

2. Tata Motors: Driving Demand Through Consumer-Centric EV Research

To a significant extent, Tata Motors has become the pioneer in the expanding electric vehicle (EV) market in India, which it has been able to achieve through strategic application of business research. Tata Motors realized at that time that it had to understand consumer feelings, since EV adoption in India was still in its early stages.

The Situation:

India’s EV landscape in the early 2020s was riddled with scepticism. The problem with high prices, lack of charging infrastructure, and range anxiety (fear that the vehicle would not travel far enough on one charge) was making consumers hesitant.

Instead of speculation, Tata Motors chose to conduct extensive market research and establish the basis of these concerns.

The Research:

Tata used a mixture of surveys, focus groups, and demographic studies in urban and semi-urban regions. The aim was to assess:

- How aware were consumers of electric vehicles?

- What were their biggest concerns?

- What price range would they consider affordable?

- What expectations did they have for range and maintenance?

The insights revealed that consumers were not entirely opposed to EVs—they simply lacked trust in the technology and the infrastructure. Affordability and practicality were the keys to winning them over.

The Strategy and Execution:

Based on these findings, Tata Motors designed the Tata Nexon EV, a compact SUV that ticked all the right boxes:

- Competitive pricing compared to traditional cars.

- A range suitable for urban commuting.

- A sleek design and features tailored for young, eco-conscious buyers.

Simultaneously, Tata invested in building EV infrastructure by partnering with other companies to install charging stations in key cities, addressing the most significant logistical barrier.

The Result:

The Tata Nexon EV quickly became India’s best-selling electric car, capturing a large share of the market and reshaping perceptions of electric vehicles in the country.

Summing Up

To conclude, effective business research enables companies to make informed decisions, reduce uncertainty, and stay competitive in ever-evolving markets. Whether it’s understanding customer behavior, analyzing financial performance, or identifying new growth opportunities, research serves as the backbone of sound strategy.

By leveraging qualitative and quantitative methods, organizations can gain a comprehensive view of their environment, tailor their offerings to meet actual demand, and respond proactively to challenges. There is enough data to demonstrate that research-driven insights can lead to game-changing outcomes, shaping industries, disrupting norms, and securing long-term success.

Ultimately, businesses that prioritize research are not just reacting to change; they are anticipating it, guiding it, and thriving because of it.