After BCom Which Course is Best?

While a Bachelor of Commerce (BCom) degree provides numerous decent opportunities, a higher qualification or specialized skill can distinguish you in India's competitive job market. In fact, employability for BCom graduates is estimated at only 48%, meaning many fresh grads struggle to find good jobs without further credentials.

Pursuing a master’s or professional certification adds in-depth knowledge and practical skills. It demonstrates to employers your specialized proficiency in fields like analytics, finance, or administration.

After completing a B.Com, top courses for enhanced career prospects include professional qualifications like Chartered Accountancy (CA), Company Secretary (CS), and Chartered Financial Analyst (CFA). Postgraduate options like Master of Commerce (M.Com) and Master of Business Administration (MBA) are also highly beneficial, alongside specialized certifications in Business Accounting & Taxation (BAT) or Digital Marketing.

Moreover, higher qualifications often lead to faster career growth and higher pay. It also goes hand in hand with companies' demand for qualified finance professionals surging (e.g., India will need 30 lakh chartered accountants in the next 20–25 years). In short, advanced studies or certifications after a BCom can significantly boost your career prospects and salary potential.

But after BCom, which course is best for girls and boys that they can choose to further their career advancements?

BCom Specializations

Before delving into the courses generally considered best to pursue after a BCom, let's first gain a detailed understanding of the BCom degree and its various specializations. A Bachelor of Commerce equips you with core business knowledge essential for diverse career paths. You learn how businesses maintain financial records, manage budgets, handle payroll and taxes, and understand economic trends.

Many BCom programs also offer specializations or elective streams. Traditional majors like accounting & finance and economics remain popular, building core skills in bookkeeping, auditing, tax, and economic analysis.

New-age options like business analytics/statistics and FinTech combine commerce with data and technology. Other common choices include marketing (focus on branding and consumer behavior), human resource management (talent and payroll management), eCommerce/digital business (online retail and logistics), banking & finance (bank operations, risk), international business, and taxation.

- Accounting & Finance: Covers financial reporting, auditing, and corporate finance. It prepares candidates for roles like accountant, auditor, or financial analyst.

- Economics: Focuses on market trends, economic policy, and data analysis. It greatly helps graduates with an interest in becoming economists or policy analysts.

- Marketing: Teaches consumer behavior, branding, and digital advertising. Career pathways include opportunities like marketing manager and brand executive.

- Human Resource Management: Covers subjects in recruitment, training, and labor laws. Graduates work as HR executives or managers.

- Business Analytics/Statistics: Equips students with knowledge around data mining and using statistical tools. Popular roles are data analyst and business intelligence specialist.

- FinTech & eCommerce: Combines finance with technology (blockchain, online payments) and online business models. It prepares students for roles in fintech startups or e-commerce firms, which are in high demand in India’s digital economy.

Each specialization comes with its own skill set and career path. By choosing a specialization that matches their strengths (analytical, creative, tech-savvy, etc.), students can position themselves for targeted roles in industry and government organizations.

Best Careers After BCom Degree

A BCom equips graduates with adaptable skills for roles in financial services, accountancy, and business leadership. You can leverage the economics, finance, and business law knowledge from your degree in roles across industries. Below are some promising career paths for students after BCom, with the key responsibilities for each.

Financial Analyst

Financial analysts evaluate a company’s fiscal data to inform investment and budgeting strategies. They use accounting and economic knowledge (learned in BCom) to interpret trends and advise management on strategy. Key responsibilities include:

- Gathering data (sales, expenses, market trends) to forecast business outcomes.

- Creating budgets, cash flow projections, and financial models to help plan for the future.

- Evaluating the performance of investments or projects and suggesting portfolio adjustments.

- Studying balance sheets, income statements, and market conditions to assess a company’s value.

Accountant

Accountants maintain precise financial records while adhering to regulatory standards. In this role, you would manage bookkeeping and prepare reports for businesses or clients. Accountants typically:

- Maintain ledgers of income and expenditures and reconcile bank statements.

- Prepare financial statements, including balance sheets, profit/loss reports, and cash flow analyses.

- Assist with internal and external audits by examining financial documents for accuracy.

- Compute and submit taxes, ensuring adherence to legal and regulatory requirements.

Business Analyst

Business analysts connect operational needs with technical implementations. They use data to help organizations improve processes and efficiency. A business analyst’s responsibilities include:

- Collaborating with stakeholders (e.g., sales, IT, operations) to understand needs and define business requirements.

- Studying business performance metrics to identify patterns, opportunities, or problems.

- Creating diagrams or documentation of current and future business processes to spot inefficiencies.

- Suggesting and facilitating improvements such as system enhancements or workflow changes to meet organizational objectives.

- Presenting findings and suggestions to managers in reports or presentations, helping to guide strategic decisions.

Marketing Manager

A marketing manager designs and leads campaigns to promote products or services. Their role focuses on acquiring new clients while maintaining relationships with current customers. Key tasks include:

- Planning and implementing marketing plans (digital, print, events) aligned with business.

- Coordinating advertising, promotions, and branding efforts, ensuring consistent messaging across channels.

- Analyzing market trends and customer feedback to refine strategies and product positioning.

- Working with creative, sales, and product teams to develop content and ensure campaigns run smoothly.

- Tracking campaign performance and metrics (like sales uplift or website traffic), and report outcomes to senior management.

Data Analyst

Data analysts transform unprocessed data into meaningful insights for business decision-making. They apply statistical techniques and software tools to find trends. A data analyst typically:

- Gather data from various sources (databases, spreadsheets, online analytics) and clean it for analysis. Maintain and update databases.

- Use statistical methods or BI tools to identify patterns, correlations, or anomalies.

- Create charts, dashboards, or reports that summarize findings in a clear way for stakeholders.

- Translate analytical results into business terms (e.g., “Sales increased by X% due to campaign Y”) to guide strategic planning.

- Present insights to managers, helping them understand complex data and make data-driven decisions.

Entrepreneur

Becoming an entrepreneur means starting and running your own business. This path can use many skills from a BCom degree. Entrepreneurs typically:

- Identify market gaps or new business ideas and create a plan to address them.

- Write a business plan, secure funding (loans, investors), and oversee the launch of the product or service.

- Handle multiple roles such as finance, marketing, operations, and HR. Make strategic decisions on pricing, budgets, and growth.

- Recruit suitable candidates and assign roles to ensure seamless business operations.

- Monitor market feedback and financial results, then pivot or refine the business model as needed to ensure success.

Insurance Underwriter

Insurance underwriters evaluate risks and determine policy conditions. They examine applicants’ information to determine coverage. The main responsibilities are:

- Examining insurance proposals and medical/financial documents to assess risk. Ensure applications meet company standards.

- Evaluating an applicant’s background and financial status to determine the likelihood of claims.

- Deciding on coverage limits, premiums, and policy conditions based on risk analysis.

- Coordinating with insurance professionals, risk assessors, or third-party specialists to obtain additional data when required.

- Maintaining records of underwriting decisions and policy documents. Guaranteeing adherence to both legal and corporate policies.

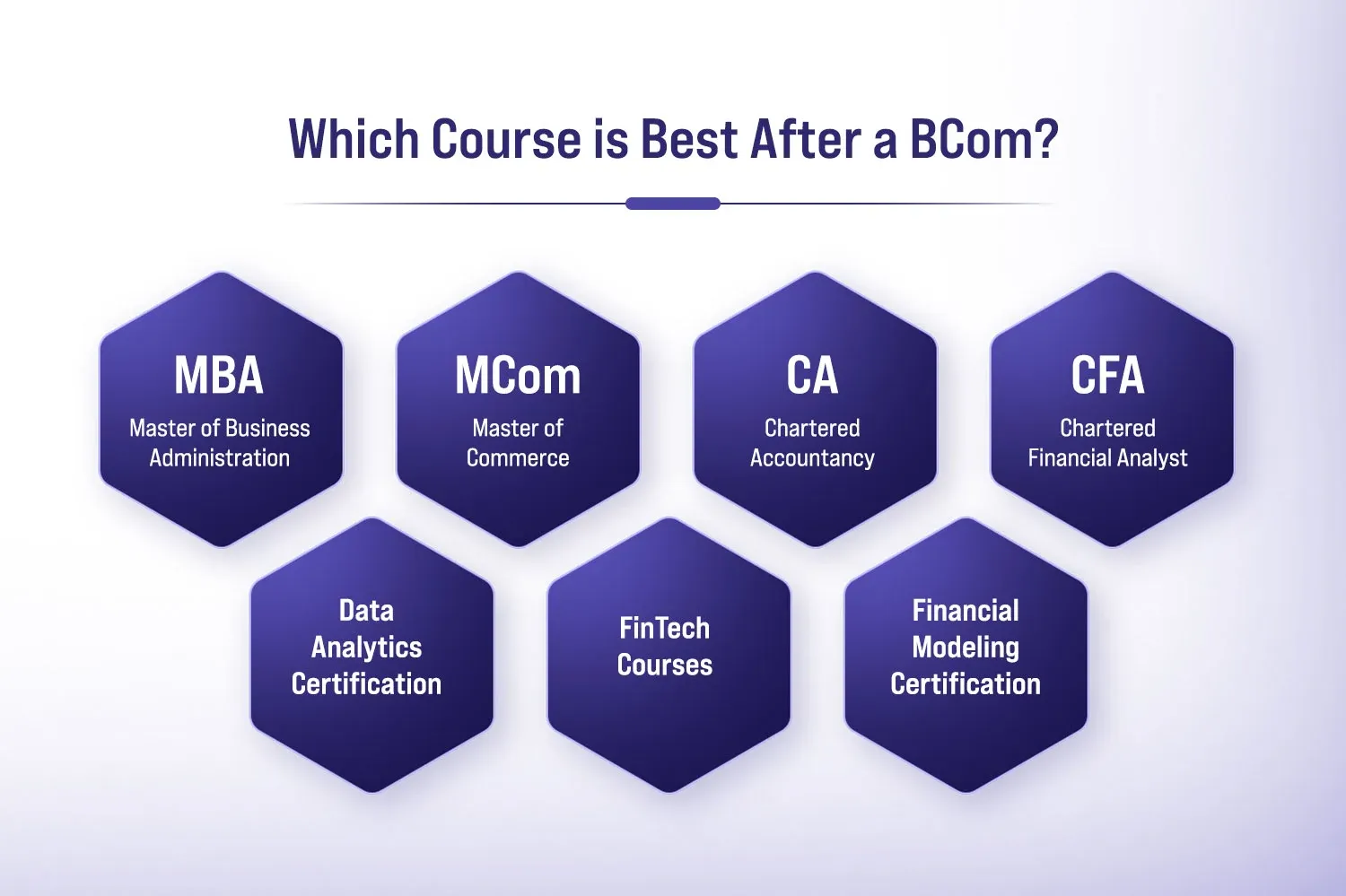

Which Course is Best After a BCom?

Choosing the right next step after a Bachelor of Commerce depends on your interests and career goals. Many graduates pursue further studies or certifications to specialize and improve job prospects. In 2025, popular options in India range from traditional postgraduate degrees to modern skill-based programs. Below are some key courses, what they focus on, who they suit best, and the kinds of careers they lead to.

Master of Business Administration (MBA)

An MBA/Pgdm is a two-year management professional degree that teaches advanced business administration and leadership skills. The curriculum usually includes marketing, operations, finance, human resources, and strategy. This course is best for BCom students who want a broad exposure to business and plan to move into managerial roles.

MBA specializations (such as finance, marketing, or human resources) allow you to tailor studies to your interests. Graduates typically enter management, consulting, or entrepreneurship. They may work in corporate leadership, strategy, or business analysis or start their own ventures.

Master of Commerce (MCom)

MCom is a two-year master’s degree that deepens academic knowledge in commerce. It covers subjects like advanced accounting, finance, economics, and business management. This program suits students who enjoyed the theoretical side of their BCom—for example, those who liked economics and accounting courses and want to focus on research or specialized finance studies.

An MCom and an MBA are typically the most sought-after academic pathways after a BCom. Graduates frequently find roles in banking, finance, or academic and research fields.

Chartered Accountancy (CA)

Chartered Accountancy is a professional credential granted by the Institute of Chartered Accountants of India (ICAI). The CA program rigorously covers accounting, auditing, taxation, and financial reporting. It is considered a prestigious and demanding course, best suited for students strong in math and accounting who are willing to put in sustained effort over several years.

CA graduates become certified accountants and auditors. Careers include roles like chartered accountant in audit firms, tax consultant, finance controller, or financial manager in companies.

Chartered Financial Analyst (CFA)

The CFA is an internationally respected certification focusing on investment strategies, asset assessment, portfolio oversight, and financial ethics. This program is suited for BCom students passionate about capital markets, investments, and financial research.

CFA charter holders often work as financial analysts, portfolio managers, equity researchers, or investment advisors. Typical career fields include investment banking, mutual funds, wealth management, and finance departments, where they apply rigorous financial analysis and investment strategies.

Data Analytics Certification

Data analytics courses (often offered as certificates or PG diplomas) teach students to collect, process, and analyze business data. For example, Google’s Data Analytics Certificate covers tools like R, SQL, Python, and Tableau to gain in-demand skills.

These programs suit BCom graduates who enjoy statistics, coding, and data-driven problem solving. Graduates learn to work with large datasets and create visual reports. This leads to careers as data analysts or business analysts. In such roles, professionals prepare, process, and analyze data to inform business decisions, helping companies improve operations, marketing strategies, or financial planning.

FinTech Courses

FinTech (financial technology) programs cover how technology is transforming finance. They include topics like blockchain, digital payments, mobile banking, and AI in finance. As CFI notes, FinTech “refers to the innovative use of technology in designing and delivering financial services and products,” from mobile apps to cryptocurrency and blockchain.

This suits students who want to combine finance knowledge with technology. Careers in FinTech include roles in fintech startups or banks’ innovation teams. Graduates may become fintech analysts, product managers, or business development managers working on digital finance solutions.

Financial Modeling Certification

Financial modeling courses train students to build spreadsheet-based models for business forecasting and valuation. As noted by the Corporate Finance Institute, “financial modeling is one of the most highly valued skills in financial analysis,” and its objective is to combine accounting, finance, and business data to forecast future performance.

This program is ideal for students proficient in Excel and financial principles. Certified financial modelers often work in corporate finance, investment banking, or equity research. Careers include financial analyst or FP&A roles where they build models to support budgeting, valuations, or strategic decisions.

Why Choose a Further Course after BCom?

A BCom degree provides a strong foundation, but the job market often demands more specialized skills. Advanced courses and certifications add expertise, boost employability, and often lead to significantly higher salaries.

For example, the average starting salary for a BCom graduate is only about ₹6 LPA, whereas an MBA or CA graduate may start at ₹8–12 LPA or more. Experts emphasize that a specialized master’s or professional course can improve chances of finding a better job and help a candidate stand out.

- Expert Knowledge: Postgraduate courses (MCom, MBA) or professional certifications (CA, CFA, data science) deepen your understanding of accounting, finance, analytics, or management. This makes you “industry-ready” with current tools and theories.

- Higher Salary & Roles: Further education qualifies you for senior and specialized roles (finance manager, consultant, analyst) that pay far more than typical entry-level positions.

- Better Career Growth: Employers often prefer candidates with master’s degrees or certifications. This opens doors to top companies and international opportunities.

- Adaptability: Commerce is evolving with technology. Continuous learning (e.g., courses in FinTech, digital marketing, or analytics) ensures your skills stay relevant. Ongoing upskilling is key to staying ahead in today’s competitive job market.

- Personal Satisfaction: Further study can also help clarify interests (you may discover a passion for teaching, research, or entrepreneurship) and provides a safety net if market conditions change.

In short, pursuing a higher degree or certification after a BCom greatly increases your career options and earning potential. It transforms broad commerce understanding into a targeted expertise sought by employers.

Summing Up

Choosing the best path after a BCom comes down to your interests, strengths, and career goals. If you enjoy numbers and laws, courses like CA, CS, or taxation may suit you. If you love business strategy, an MBA or MCom could open management roles. For those drawn to tech and data, certifications in analytics, data science, or FinTech are promising.

Digital skills (e.g., digital marketing, web development) are also valuable in today’s market. Whatever you choose, remember that further education can greatly boost your employability and salary.

Ultimately, the ideal post-BCom course aligns with your career aspirations. Research each option carefully: look at the curriculum, possible careers and salaries, and even talk to professionals in the field. With the right choice, your BCom can be the launching pad to a rewarding, high-paying career.